The Art Of Investing In Art

A Picasso masterpiece, the “Women of Algiers” was sold for close to USD 180 million, the highest ever for a painting.

My father was an avid painter, whilst he was studying medicine, he took up another room just for his paintings. He conducted two exhibitions of his own, and today some of his paintings adorn the walls of hospitals around the UK.

Whilst I believe I have his aesthetic touch, I probably didn’t pick up his talent in art… instead for me, it was art of investing.

I’ve been fascinated about how artists, both alive and dead manage to sell their paintings for such large sums of money, and that there are Art Funds that buy exotic art and sell them for a return on investment. I even went to the extent of meeting my wife’s cousin all the way in New York, who was the curator of the National Museum to understand how paintings become so popular.

In life, you need to have clarity, and that comes from Vision + Focus. The vision is your ability to see the future, and Focus is the ability to concentrate on the current.

You cannot go to either extreme, because your vision might be clouded and uncertain, causing you to become negative, pessimistic or downright depressing and if you’re paying too much focus on the current, you’ll be spending away your life in idleness and complacency without thinking about the future. The middle path is always the best - so combine the right amount of vision and focus to gain clarity. Once you have clarity, you have purpose and your mission is more forceful. Art, can help you practice that... as it places you at a point in time - the present.

So what is the difference between a stock investor and an art investor?

Well, for one - the stock investor is looking at the future equity value of the underlying, whereas the art investor is looking at the current aesthetic value. Whilst both art and stocks can have their own stories behind them, when you invest in art, you need to have a personal connection with the piece, the artist and the emotions that stir you. That doesn’t mean you should fall in love with the art, if you did, you wouldn’t sell and then it no longer becomes an investment. In short, whether it be it stocks or art - don’t marry them.

It’s all about perspective, the way it is framed. You’ve probably heard the story about the famous artist Joshua Bell, who played on his $1 million violin in the subway, the same piece he would play in front of a full house of the Philharmonic Orchestra, with each ticket costing thousands. It’s the same thing - what you may see as limited value, may be perceived as something of great value to others. Learn to recognize this supply and demand game being played around you…

The beauty (sorry for the pun) of investing in art is that it is illiquid, prices change from year to year, not from day to day. And that’s why it retains value, like real estate. (There’s a saying that real estate can never die, but only grow sick). The easier it is to sell an asset, the more discipline you need to practice. If it sounds like a buy-and-hold strategy to you, that’s because it probably is. Another good reason for investing in art is that art is private, portable, and non-reportable.

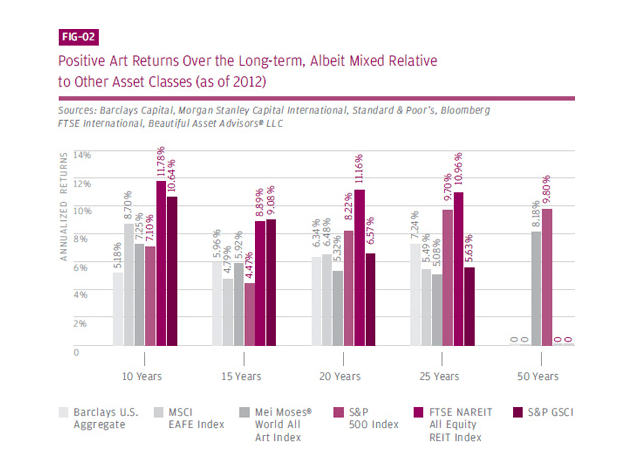

According to Kyle Sommers of JPMorgan Chase, “Art tends to move in slow and long-term cycles. Looking at performance on a risk-adjusted basis (returns divided by standard deviation) over the last 50 years, the Mei Moses World All Art Index matched that of the S&P 500 Index. On a 25-year basis, the Mei Moses World All Art Index looked relatively strong, outpacing the MSCI EAFE as well as the S&P 500.”

The psychology behind art investing…

You’re most likely to fetch greater value, when a) you don’t want to sell it because you begin to love it and b) there’s only piece. Nothing has changed in the value of the art piece, it’s just that someone else is willing to pay a higher price to enjoy it (that’s how civilized society works, through trade and not violence and pilferage).

I remember a friend telling me how scarcity causes value to go up… he narrated a story about a famous collectors edition baseball card. There were only two in existence, one with the his friend and another with another collector. His friend went in search of the second one and paid $12,000 for it.

Then he took a lighter and just set the card he just bought on fire… my friend was astonished and asked him why he did that after paying a hefty sum.

His answer: Supply & Demand. With two cards in existence, his card was only worth $10,000, because a recent transaction took place. But with only one last card… the value just went above $20,000, even more because there were no other copies available. That’s art at its finest!

Member discussion