Don’t Build Properties, Build People & The Power Law

- Why regional investors need to start looking at taking more risk if the startup environment is going to succeed.

- The Power Law, and why a few successful investments will change the game for the region.

Over the last year, I’ve been closely associated with the Bahrain (and Middle East) startup scene. Prior to that I’ve spent a good decade in the private equity space. And one thing I’ve come to realize is that investors in this part of the world - are more comfortable with real estate investing than startup investing. Who wouldn’t be, you get nice yields on investments! Until you don’t.

There’s a reason for this status quo, and it has a lot to with the old saying...

"Real Estate never dies, it only grows sick".

This is ingrained into psyche of most investors in this region, and it will take a good amount of time and effort to change that mindset. But until that happens, those who invest primarily in real estate will struggle to understand startup economics.

Only when investors start moving away from ‘sure shot’ real estate to ‘high risk’ venture capital, will things begin to change. But for this to happen, we need a few success stories - where someone who invested in a startup, made a 10x or 100x return. That person (founder or investor) would typically be inclined to throw more seeds from his harvest across a larger number of promising ventures, and so begin the cycle of wealth creation.

You see, when they reach this stage of success - it becomes addictive. They would then stumble upon the Power Law - which incase you didn’t know - is where the return from your single best investment would be more than all your investments combined, and the second best investment would be better than the next three put together.

But for the Power Law to kick in, investors need to start making bets. In stock trading, we have a saying… “No trigger, no trade”. The sooner they pull the trigger on startup investing, the faster the Power Law will kick in.

Think of this situation, the investor complains about why the startup does not make any money, negative cash flows etc. He fails to understand that unlike in constructing a building or property, where you use low-skill labour, here you’re required to take on expensive, skilled to highly skilled engineers, product managers, customer support and marketing specialists to launch the company off the ground, build and scale it.

This of course is difficult for our real estate investor to comprehend, because he’s using a different measuring stick - that of rental cash flows, IRRs, bank leverage and little-to-no-loss. For him, doubling money is great, but losing little is unspeakable.

Compare that with startup investing - 100x returns for a high level risk of failure, combined with the long time to become profitable. Doesn’t look so good on the surface!?

When done well, angel and startup investing can be not only profitable, but generate huge outsized returns. Just keep in mind that if Real Estate and Private Equity composes 10%-15% of your portfolio - Seed, Angel and Venture Capital combined should compose not more than 5% - so risk accordingly.

And while you’re doing the math, ask yourself the question - why is it that Saudi Arabia is the most avid consumer of online video content, yet there was no startup similar to Youtube that came out of Saudi. Or why India is the largest user of Facebook, but no such social media platform sprung from there.

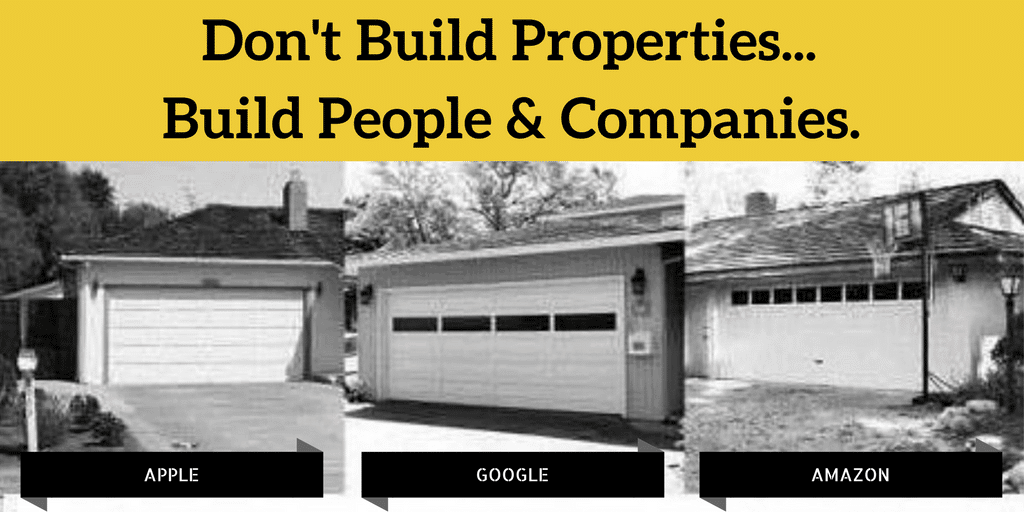

What makes Silicon Valley companies successful outside their hometown, on a global scale. Was it the money, or the people behind it? All I can say is… why don’t we stop building properties, and start building people. The image below should hopefully serve as a reminder of where these companies begun.

Member discussion