The 10 Biggest Mistakes Entrepreneurs Make When Raising Funds and How to Avoid Them

So you've been looking at the Mark Zuckerbergs and the Bill Gateses of this world and asking yourself, what makes them special? What makes them tick? Well, it might come as a relief to know that they're just normal guys with heart.

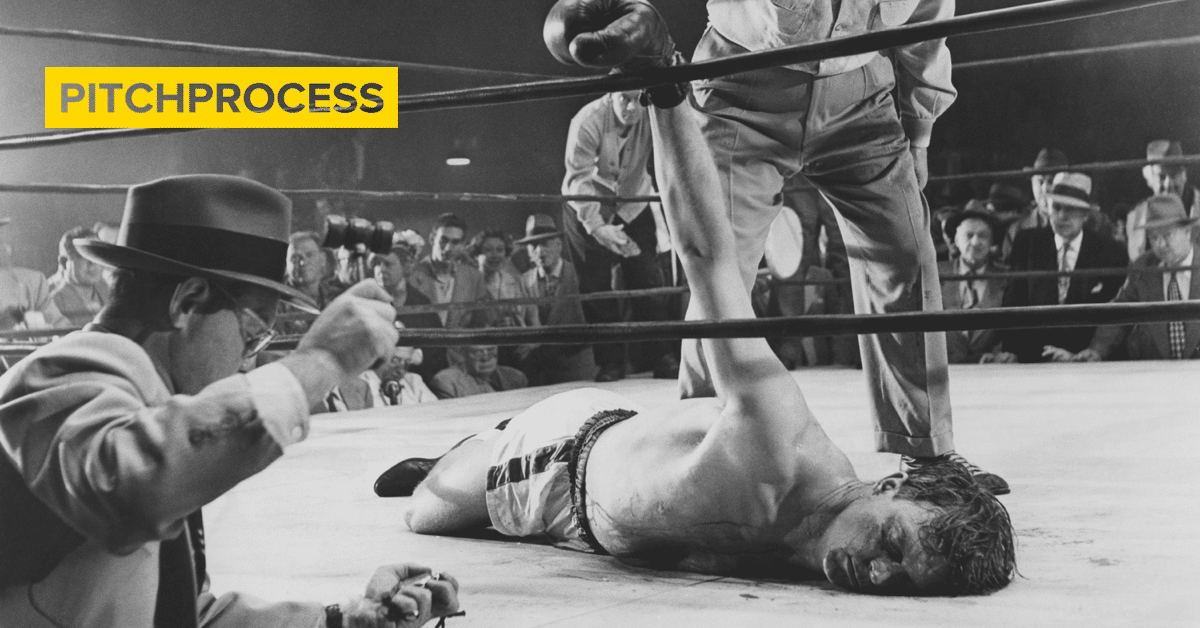

It's not their superior education or hard work that made them super-successful; rather, it's their very persistent spirit. What makes them stand out from ordinary entrepreneurs is their incredible ability to get back on track every time they experience a setback.

You've probably already realized that running a business is a daunting task. It is an even scarier experience when you are starting a new business and have no idea where the funds are going to come from.

Networking plays a key role when it comes to raising funds for your business. Your inner circle should be powerful enough to connect you to the right people and organizations.

According to a study by Forbes , 90% of new enterprises are destined to fail. This probably explains why many start-ups are opting to raise capital using the crowdfunding market. The World Bank predicts that this market will be worth $96 billion by 2025.

Entrepreneurs can reach investors using crowdfunding platforms like Crowdfunder, Circle Up and Crowdcube.

Many entrepreneurs cite lack of adequate funds as one of the main reasons their businesses fail to take off, stall or die eventually. However, money problems can be prevented or contained if they are handled in the right manner.

This article looks to enlighten entrepreneurs on the best tricks to use when raising funds for their businesses and the mistakes to avoid when doing so. Below are some of those mistakes:

1. Being a lone ranger

Starting a new business involves entering into the unknown, and therefore you will need as much help as you can get. Many successful ventures were executed through partnerships (well, except for a few special guys like Oracle’s Larry Ellison).

Businesses often experience a number of setbacks, and the variety of tasks can simply be too much for one person. Even when you're the sole founder of a company, you will still need a capable team to execute your dreams. A little boost from friends and colleagues is not a bad idea, after all.

Many entrepreneurs make the mistake of going it alone and eventually suffer from failure. Not only is a business partner a good source of motivation during the low moments, but he or she also brings an alternative source of funding to the table.

Having multiple investors definitely increases the success chances of any business. However, always remember that a partner should help you improve sales. If this is not the case, then you are better off alone.

2. Overly high valuation

If you have watched “Shark Tank,” then you know that many entrepreneurs tend to overestimate the value of their companies. This is a problem that is especially common with newbies who own start-ups.

These entrepreneurs make the mistake of using models that come up with an unrealistic net present value. The fancy models are also quite expensive.

Valuation is done with regard to conditions within the economy, future forecasting and comparables. But in the end, your company is only worth what investors are willing to offer you.

According to a January 2016 report by The Wall Street Journal, an increased fear of investing in new businesses resulted in the lowest valuation of start-ups since 2012.

In order to attract investors, entrepreneurs should work on coming up with realistic and appealing valuations of their companies based on growth potential. This is not an easy task, but you must remember that most investors expect the company grow within eighteen months of inception.

3. Ignoring the lawyer

Maybe you're working on a budget, or maybe you feel that you can do everything by yourself, but whatever excuses you may have, it is not a good idea for you to enter into major transactions without a lawyer.

When selling your business or raising funds, it is important to seek the legal advice of a lawyer in order to avoid unforeseen investment disputes in the future. However, you should not overly rely on a lawyer for day-to-day business issues that you can handle yourself.

4. Not asking for introductions

Many entrepreneurs fail to put themselves in positions where they can meet potential investors, arguing that they are unapproachable.

You might not have a personal relationship with a potential investor, but there are a couple of ways to get his or her attention. You should consider seeking advice from your mentors or opinion leaders within your reach on the best way to deal with this problem.

These people should be able to advise you on which investors are best suited for you, and you never know – they might actually hook you up with the investors!

5. Assuming the investor will call you back

So you have finally managed to land that coveted meeting with a potential investor and you are almost sure that you nailed the deal. You are patiently waiting for him or her to call you back, but it is taking forever. Sounds familiar?

Most potential investors are entrepreneurs themselves, and some even have full-time jobs. This means that most of them have very busy schedules, and therefore you have to remind them about your company.

When communicating with the investor, you should let him or her know exactly when you would like an answer so that he or she does not hold up your plans by taking too long. You should demand for a firm answer (in a respectful manner, of course).

Oh, and please remember to send the investor an invitation on caplinked.com.

6. Thinking that money is the solution to all issues

Many entrepreneurs with money problems feel that they can stabilize things by pouring in some more money every time their business is struggling. This could not be further from the truth: some problems are rooted in the set-up of the business model.

According to Carter Cast, an entrepreneurship professor at the Kellogg School of Management, you have to ensure your model can be actualized before moving to the pocket, and not the other way round.

7. Fear of failure

Although many successful entrepreneurs have empowering stories about how they failed many times before they tasted success, it still doesn’t make it any easier on the normal folks who have to deal with the daily setbacks of a start-up.

When raising funds or doing business in general, it is important to always maintain a positive attitude. Your mindset can affect the performance of your business. Every entrepreneur should view failure as a learning experience for moving into the future.

8. Complicated terms of agreement

Many entrepreneurs fall into terrible deals that are well hidden using complicated terms. Some angel investors might offer you a complex contract that has hidden clauses that might haunt you in the future. These clauses normally give the investor some special rights followed up with stipulations.

When structuring an investment, you should protect yourself from investors who might take advantage of you by considering the KISS (Keep It Short and Simple) formula. Another reason this is important is that you do not want to scare away future investors who might not like the excessive privileges that you gave to your first investor.

9. Using your equity to fund the company

Many beginning entrepreneurs make the mistake of using their equity in the business to come up with funds that the company needs. This is a risky idea, because before you know it you might end up a minority owner or out of control of your own business.

When dealing with this kind of issue, the entrepreneur should use alternative means of raising money to fund the company while still maintaining control of it.

10. Unorganized Data

Many entrepreneurs, especially the newbies, lose good deals because of poor data maintenance and presentation.

As a good entrepreneur, you should always have a binding or non-binding term sheet as well as supplementary documents like non-disclosure agreements, intellectual property protection and employee data.

You should consider using templates and other legal documents from our library of resources.

One final bonus reason

1. Misjudging how long the fund raising will take

This is a common mistake made by many entrepreneurs. What they fail to realize is that the process of finding the best investor and getting access to the funds can take quite a while.

This process can often last for 3-6 months, and therefore a smart entrepreneur needs to identify an alternative way of keeping the business active before the fundraising is completed.

Let’s put it all together

So there you have it, folks. As you have seen above, there are many factors that determine whether one is going to be a successful entrepreneur or just another statistic among those who tried and failed.

Remember to come up with a realistic and comprehensive business plan that you can always refer to every time you encounter hardships. Even the best funded, most brilliant ideas can fail if not executed well.

Learn from the above mistakes made by others, and you are good to rock that business!

Member discussion