India Incorporated (How To Incorporate In India)

It's happening. India is on the move. To put it another way, when a large elephant wakes up, and starts moving. The earth shakes. That's India Incorporated, and incorporating in India just got easier. In fact, the doing business in India index just jumped a few ranks, the highest jump amongst all countries.

When the 2008 LLP Act was introduced, I thought it was landmark. I even went ahead and started a company (limited liability partnership) to go through the experience. And while it was fairly easy, setting up the bank account - was the biggest challenge. And because the bankers had no idea of the required documentation for an LLP vs Private Ltd Company - I went ahead and closed it down. It was a fairly simple process, that cost me a few lakhs from open to close. And not being in India was one of the drawbacks, the rule at the time was that one of the directors (or designated partners) had to be a resident Indian. And while that was not much of a problem, the issue was of opening a bank account!

Type of Company Structures / Business Formation:

Ever since, there has been progress in terms of setting up and legal structures. The 3 key company structures that you can set up in India are:

- Private Limited Company (Private Limited)

- Limited Liability Partnership (LLP)

- One Person Company (OPC)

These structures have proved to be more beneficial than the older structures that have existed. The other structures available include Public Limited Company (Limited), Partnership & Proprietorship. The latest being the One Person Company as a way to encourage corporatization of micro businesses (that’s another way of saying the government is trying to make it easier to tax business).

For instance, if you’re looking to create a product based company - the Private Limited Company or PLC structure might be best, especially if you’re trying to raise money from investors. If on the other hand, you’re looking to provide a service based company - consider the Limited Liability Partnership or LLP as the best structure. There are some advantages to the LLP over a normal partnership, which is even why Big 4 firms like KPMG have shifted from a partnership to a limited liability partnership, not only to limit risk, but to also save on the tax. If you’re a sole founder, and just want to get started - you could consider the One Person Company, which is similar to the PLC in some respects, and can even be converted into one easier.

[table id=1 /]

Terms that you should be familiar with:

Registered Office - This can be your home (owned or rented), not necessarily your primary place of business, but more importantly it should be capable of receiving communication. It need not be a proper office, but you must register with the Ministry of Corporate Affairs, Government of India ("MCA").

Director Identification Number (DIN) or (DPIN) - is a unique lifetime eight-digit identification number which is allotted to an individual who is an existing director or proposed directors of a company, issued by the Ministry of Corporate Affairs, Government of India. To setup you’ll need to complete & submit a form DIR-3 and to update any particulars of the director, you’ll need to complete & submit a form DIR-6 accordingly. It’s a 100% online process, and costs INR 500, to be paid via the portal.

Digital Signature Certificate (DSC) - is an electronic signature key that can be used by the designated partner/director for filing online (e-filing). It is necessary for digitally signing the electronic incorporation documents. A digital signature is a type of asymmetric cryptography used to simulate the security properties of a handwritten signature on paper. DSC have often been confused with scanned copies of a physical written signature, which do not have any legal backing for authentication of electronic documents.

Corporate Identification Number (CIN) - CIN is the unique identification number allotted to a company registered in India by the Ministry of Corporate Affairs, Government of India. CIN is a 21-digit alpha-numeric number that contains the information such as status (listed / unlisted), NIC code of business activity, state of registration, year of registration, private or public and the sequential registration number in the respective state.

Micro, Small & Medium Enterprises (MSME) - registering as a MSME, will provide many benefits, loan schemes, perks & reduced tax.

GST Registration - Goods and Service (GST) is a single and comprehensive tax on the supply of goods and services across India, right from the manufacturer to the Consumer. Every person needs to get registered under GST in the state from where he makes taxable supply of goods and/or services, if his aggregate turnover in a financial year exceeds INR 20 Lakhs (INR 10 Lakhs in North Eastern States including Sikkim).

GST Loan Scheme - Companies that have registered MSME certificate can obtain a collateral free loan from the government based on their GST returns filed previously. The owners of the MSME should be IT and GST compliant and should have 6-month bank statement available. The MSME has access to the loan amount of Rs 10 lakh to Rs. 1 crore. The rate of interest relevant to this loan facility is 8% and can be availed in 60 minutes through GSTIN.

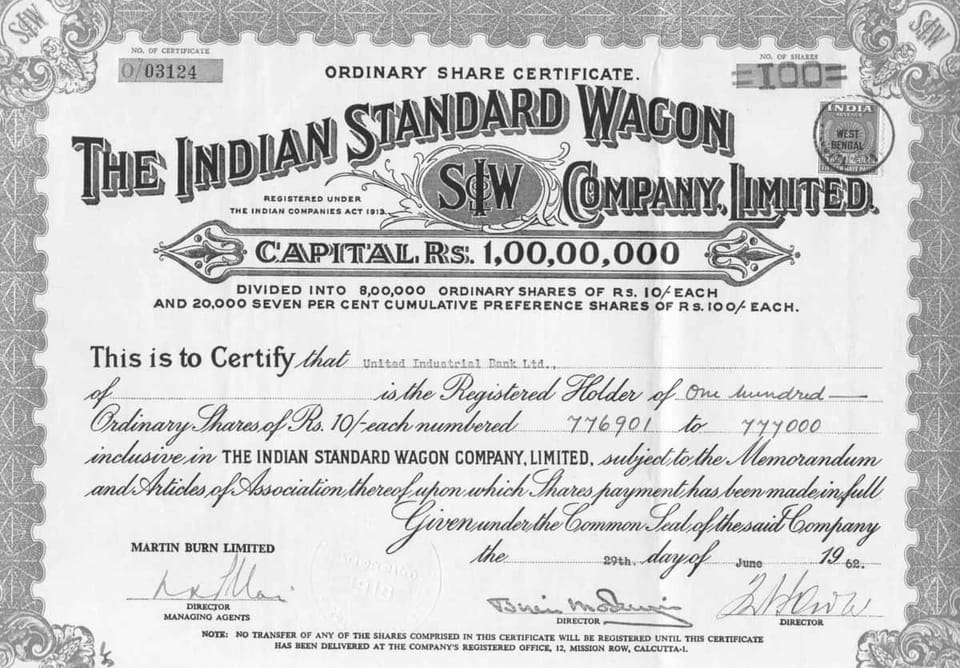

Memorandum of Association (MOA) - this is the charter document of the company and contains the name of the company, the state in which the registered office of the company is located, objectives, and its authorized capital. The MOA will be filed and digitally signed by the initial promoters of the company form INC-33. They will also have to write their name, father's name, residential address, occupation and the number of shares they agree to subscribe in the company. The MOA should also bear name and DSC of the witness who knows the subscribers.

Articles of Association (AOA) - this document contains rules and regulations for the management of the company's internal affairs and conduct of its business. It defines the relationship of company between its members and directors and vice versa. It also describes powers of directors. Further, the AOA describes the rights and duties of its members as well as the duties, powers and responsibilities of its directors. In case of a private limited company, the AOA will contain restrictions on transfer of shares, if any. Also, AOA contains the names of first subscribers of a company.

The AOA will be filed and digitally signed by the initial promoters of the company in form INC-34. Promoters will also have to write their name, residential address, and occupation and the number of shares they agree to subscribe in the company. The AOA should also bear the name and DSC of the witness who knows the subscribers.

Does the company require special approvals/licenses for certain activities?

Yes, typically you would. Activities including banking, venture capital, stock exchange, asset management, mutual fund, merchant banking, securitisation & reconstruction, chit fund & non-banking financial activities require the prior permission from the Indian regulatory bodies such as SEBI, RBI, etc.

However, what I’ve noticed that so long as you pay your taxes, you can ‘start’ and then get approval later on for some activities. There always seems to be a way around these things. (This is my personal opinion and not a legal, tax advice - consult accordingly).

How do you close / shut down a company?

While starting up easy, closing is difficult (particularly in India). You should also be aware of how easy/difficult it is to sell/close the company. There are basically three options you have:

- Sell.

- Declare Defunct.

- Wind Up & Dissolve.

My experience with an LLP closure was pretty straight forward. You would need to file an application for striking the name from records with the registrar. You could either declare your company defunct or wind up by a quasi-judicial tribunal. (I believe so long as you can sign an indemnity letter / bond that holds you responsible, you should be okay. If you’re not comfortable with this, go through the proper route mentioned above.)

It is necessary to intimate the Registrar of Companies (ROC) for the closure of Private Limited Company (Private Limited) to update the MCA data and make company free from all its legal compliances. For Companies & LLPs, it is mandatory to appoint a provisional liquidator or liquidator from the panel especially if the Company or the LLP has liabilities and assets.

Side Note: I understand from a founder friend that instead of closing a company directly, wherein you could end up taking 3 years to close it officially, it is better to make it "inactive", by waiting one year after your last bank transaction. This gives you almost a one year period to decide whether you want to re-activate the company or just close it down. The cost of filing would apparently be higher through the normal route, whereas the filing for an inactive company is a simpler affair.

Do you really need to register your company?

The answer is surprisingly no. But having a legal entity can protect you and provide you a vessel for moving forward with your business idea (and it shows you're serious). If you're just testing out your idea, and haven't got paying customers yet - think about it. You will have to setup a Current Account in a bank and complete a Service Tax registration, to get started. The problem in India is the compliance burden is so high on the entrepreneurs, that some times it may not seem worth the effort of setting up.

How long will it take to incorporate a company in India?

While the country has been moving up the index in terms of ease of doing business. It still takes anywhere between 7 - 30 days to incorporate. While that may seem like a long time, I've seen countries promote 24 hours, only that you can't do anything with those companies until you get all the requisite activity licenses - making it totally useless.

Here are a couple of companies you can avail of for company registration & incorporation:

- CompaniesInn - for company registration (I've personally used them, they were the first to register LLPs in India, and also have done for Flipkart - if that brings you any luck :)

- TreeLife (they're focused on startups, and provide more wholistic services that would be required to manage your business. I've interacted with the founders.)

- QuickCompany (provide probably the cheapest and most well done site)

- EnterSlice (they appear to have a focus on other countries, and also on FinTech)

- LegalWiz (not reviewed)

- StartupWala (not reviewed)

- Wazzeer (not reviewed)

- Hubco (not reviewed)

- Government Website

Thanks to the Veyrah Law team for the review & edits.

Member discussion